How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory . many companies use standard cost to account for their inventories. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. calculating absorption cost involves summing up all the direct and indirect costs associated with the. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. to calculate manufacturing overhead, combine all manufacturing overhead costs. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. Divide this by the total.

from www.numerade.com

with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the. to calculate manufacturing overhead, combine all manufacturing overhead costs. many companies use standard cost to account for their inventories. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. calculating absorption cost involves summing up all the direct and indirect costs associated with the. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. Divide this by the total. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the.

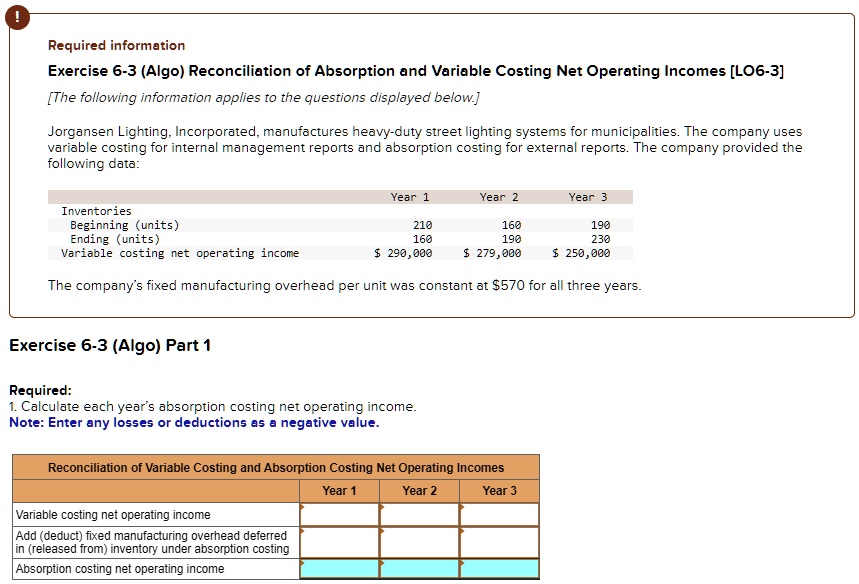

SOLVED Year 1 Year 2 Year 3 Variable costing net operating Add

How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. Divide this by the total. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. calculating absorption cost involves summing up all the direct and indirect costs associated with the. to calculate manufacturing overhead, combine all manufacturing overhead costs. many companies use standard cost to account for their inventories.

From www.numerade.com

SOLVED Year 1 Year 2 Year 3 Variable costing net operating Add How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. Divide this by the total. calculating absorption cost involves summing up. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.chegg.com

Solved Multiple Choice The amount of fixed manufacturing How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. Divide this by the total. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. to calculate manufacturing overhead, combine all manufacturing overhead costs. calculating absorption cost involves summing up all the direct and indirect. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.educba.com

Manufacturing Overhead Formula Calculator (with Excel Template) How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. many companies use standard cost to account for their inventories. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. Web. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From haipernews.com

How To Calculate Cost Of Goods Sold And Ending Inventory Haiper How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate manufacturing overhead, combine all manufacturing overhead costs. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. calculating absorption cost involves summing up all the direct and indirect costs associated with the. with absorption. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From karterkruwcooley.blogspot.com

Value of Ending Inventory Using Variable Costing KarterkruwCooley How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory many companies use standard cost to account for their inventories. calculating absorption cost involves summing up all the direct and indirect costs associated with the. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the. Divide this by the total. the graph shows that absorption costing. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.chegg.com

Solved I'm having issues finding the fixed manufacturing How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory many companies use standard cost to account for their inventories. to calculate manufacturing overhead, combine all manufacturing overhead costs. calculating absorption cost involves summing up all the direct and indirect costs associated with the. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. total product cost = direct. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From haipernews.com

How To Calculate Fixed Overhead Cost Per Unit Haiper How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.inflowinventory.com

Learn How to Use the Total Manufacturing Cost Formula How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. to calculate manufacturing overhead, combine all manufacturing overhead costs. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.chegg.com

Solved Vitex, Incorporated manufactures a popular consumer How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate manufacturing overhead, combine all manufacturing overhead costs. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. Divide this. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.homeworklib.com

Ida Sidha Karya Company is a familyowned company located in the How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate manufacturing overhead, combine all manufacturing overhead costs. calculating absorption cost involves summing up all the direct and indirect costs associated with the. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. Divide this by the total. to calculate the fixed manufacturing overhead cost deferred in inventory, you first. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.chegg.com

Solved Multiple Choice The amount of fixed manufacturing How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. calculating absorption cost involves summing up all the direct and indirect costs. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.chegg.com

Solved Wolanski Corporation has provided the following data How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. Divide this by the total. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the. calculating absorption cost involves summing up all the direct and indirect costs associated with the. to. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From haipernews.com

How To Calculate Fixed Manufacturing Overhead Cost Deferred In How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory calculating absorption cost involves summing up all the direct and indirect costs associated with the. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. with absorption costing, the fixed overhead costs, such as marketing, were allocated. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From brainly.com

The following cost data relate to the manufacturing activities of Chang How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate manufacturing overhead, combine all manufacturing overhead costs. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. calculating absorption cost involves summing up all the direct and indirect costs associated with the. total product cost = direct materials + direct labor + variable manufacturing overhead + fixed. Divide. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.accountingformanagement.org

Problem1 (Variable costing statement and reconciliation How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory to calculate manufacturing overhead, combine all manufacturing overhead costs. calculating absorption cost involves summing up all the direct and indirect costs associated with the. many companies use standard cost to account for their inventories. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the. total. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.coursehero.com

[Solved] Job Costs Using a Plantwide Overhead Rate Perrin Company How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory calculating absorption cost involves summing up all the direct and indirect costs associated with the. Divide this by the total. to calculate manufacturing overhead, combine all manufacturing overhead costs. many companies use standard cost to account for their inventories. the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.chegg.com

Solved Billy Bob's Manufacturing had the following data for How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory Divide this by the total. to calculate the fixed manufacturing overhead cost deferred in inventory, you first need to determine the. many companies use standard cost to account for their inventories. calculating absorption cost involves summing up all the direct and indirect costs associated with the. the graph shows that absorption costing takes what is a. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.

From www.slideserve.com

PPT Chapter 15 PowerPoint Presentation, free download ID268429 How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory the graph shows that absorption costing takes what is a fixed cost ($10,000 per year), and converts it to a cost per unit of activity, effectively treating it as a. to calculate manufacturing overhead, combine all manufacturing overhead costs. with absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the. How To Calculate Fixed Manufacturing Overhead Cost Deferred In Inventory.